“Buy silver” is the mantra promoted by many preppers. For those of you pondering this, you may be wondering exactly what the best silver for survival to buy is. That’s a good question, and I have a suggestion toward the end of this article, but before you race there to see, it’s important to read through the entire article so you can get a full understanding of preppers’ affinity for silver.

I’m not only a prepper, but I’ve bought and sold silver countless times over the years, so while I am no coin expert, I know enough about silver to navigate the market and know where to buy it, what to buy, and what sells best should you need to offload it.

Why Preppers Invest in Silver

Preppers like precious metals, and they generally favor silver over gold or platinum. There are several reasons for this.

Gold and silver love bad economic news. When times get tough, people flock to precious metals. These metals are seen as safe haven assets when economic uncertainty abounds. If you’re prepping, you’re doing it because you think times are or will be tough. It only makes sense that preppers would see precious metals as an extension of their preps.

Silver and gold have intrinsic value. People might debate the intrinsic value of metals (it has different definitions depending on who you ask), but the important point here is that the value of the metal is within the metal itself.

Compare that, for example, to a paper dollar bill. There is no value in the paper, only in what the paper represents. With precious metals, you hold the worth of it in your hand. The comparison is the same as stocks (representing ownership of a company) and real estate (something you can touch).

Silver can be used for bartering. If the grid goes down, SHTF and TEOTWAWKI hits, paper currency will be useless. People will need to rely on something else as an exchange of value, and what better than precious metals? Gold and silver have very long histories of use as currency.

The Silver Preference

Silver has been called “the poor man’s gold,” but if you own a good pile of silver, that doesn’t sound so poor to me. In fact, while there are obvious similarities between gold and silver, it is widely recognized within the prepper community that silver is the preferred metal. There are several reasons for this.

Silver costs less. You can buy silver more easily than gold because it’s cheaper. This allows you to start building your stash more quickly and to increase it more easily over time. Spending a little money to have ounces of silver in your hand creates a faster sense of gratification than waiting months to save for an ounce of gold.

Silver has more uses than gold. Silver is used in photography, jewelry, batteries, and electronics. Additional uses include medical applications, solar energy, food hygiene, and water purification. It has more real-world applications.

Silver is better for bartering. The problem with gold being used for bartering is that it’s just so expensive. It’s hard to barter with a 1oz gold coin. How do you break it up? Compare that to “junk” silver, which is much easier to work with as a currency in transactions.

Why Buying Silver is a Bad Idea

Let me play the devil’s advocate for a moment, because there are many preppers who will tell you buying silver is a terrible idea, and their arguments are not without merit.

The reason buying silver is a bad idea is because you are buying a “useless” item. I know I just went over its many uses, but from a prepper’s perspective, after a collapse, how – exactly – are you going to use that silver?

It’s not going to keep you warm. You can’t cook with it. You can’t eat it. You can’t heal wounds with it. Oh – right – bartering. Well, when the apocalypse hits and you want to offer me a few silver coins for my post-apocalyptic cans of Spam, know what my response will be? Take a hike!

The argument goes that you are much better off buying bulk ammo and freeze-dried foods. Items like those you can use after the apocalypse and use for bartering. In some preppers’ minds, that’s win-win.

Back on the opposite side of the silver coin, what if the apocalypse never actually hits and you have shelves upon shelves of freeze-dried food? Are you going to eat it all? You might… might. But silver – that will last longer than any can of freeze-dried food and it can be used to put toward a house, car, or left in your will for surviving family members.

So, if you’re in the “silver is a waste” mindset, you can probably stop reading here. If, on the other hand, you love that shiny metal as much as I do, read about…

5 Ways to Buy Silver

I am going to talk about the types of silver you can buy. If you want to purchase silver, you can either visit your local coin dealer or visit one of the many retailers online such as Money Metals Exchange (my favorite) or Universal Coin.

There are 5 basic ways you can buy silver:

- silver “stuff” (junk coins, mint coins, bars, and rounds),

- junk silver,

- silver eagles,

- silver rounds, and

- silver bars.

There are other ways to invest in silver, through stocks in mining companies as an example, but they don’t put the actual silver in your hand, which is silver’s best attribute, and from a prepper’s perspective, all that matters.

1 – Buy Silver “Stuff”

Once you begin looking for it, you will find silver all over the place. In fact, you probably own some already in sterling silver jewelry. Silver is also used extensively in higher-end silverware, serving dishes, etc. These products hold their value. You may not get collector-level value for them, but they will always be worth their “melt value,” i.e., what the silver content is worth if the products were melted down.

What is sterling silver and how does it differ from pure silver?

Sterling silver is pure silver mixed with a bit of copper, zinc, or nickel – 7.5% of other metals to be exact. That makes sterling silver 92.5% pure. These other metals are added to make the end product more functional, because without it, the product would simply be too soft as pure silver.

Sterling silver is usually stamped “SS” or “92.5” or something similar. That leaves no question as to how much silver it contains. You simply weigh the item and take 92.5% of the weight. That’s how much silver you have. Buying silver stuff may hold interest for some, particularly if you see it as a hobby. There are some pretty, old items out there sold as “scrap silver.”

Pure silver is 99.9% silver, and it is what most silver rounds and bars are made from. You will not find 100% pure silver. It doesn’t exist.

You can get pure silver “stuff,” however, but it is mostly novelty, such as these silver “bullets” I purchased from Money Metals Exchange.

You will pay a little extra for these for the novelty factor, but they’re fun.

I like silver stuff because some of it can be quite exquisite. It’s silver shaped into a useful or ornamental object. The only problem with it is that you must know what you’re doing if you’re buying silver of this type. You could be paying an unnecessary premium just because it’s crafted into something. It’s also difficult to resell or barter with.

2 – Junk Silver

Junk silver is what most preppers believe to be the best method. Junk silver mainly refers to older coins that are made of varying amounts of silver with 90% being the most common.

They’re called “junk” only because they hold no collector value. The value in the coin is in the silver itself. They’re plentiful and most people know what they’re worth.

A good site to check the value of older coins is Coinflation. There you can check daily prices for old coins of different years. Generally, if you have a coin made before 1965 it has silver in it.

Rarely you might find such an old coin in your daily travels, but very rarely. People scooped these up long ago. I hear that casinos will still come across them from older people who bring out stashes of old quarters to insert into the machines. These casinos then separate those coins and sell them in bulk.

Years ago, I ran an experiment. I went to the bank and asked for $100 worth of rolled dimes. I spent probably an hour going through each one. I found ONE pre-1965 dime. It wasn’t worth the search. My eyes couldn’t see straight by the end of it.

If you’re good at it, though, and have good hearing, you can pick up the different sound a junk silver coin makes. That is a faster way of sifting through coins if you’re adept at it and are in a situation where you are handling mass amounts of old coins.

3 – Silver Eagles

Everyone knows the silver eagle. They are made by the U.S. Mint and they are beautiful coins. You will pay a premium for these coins.

Why do they cost more? The detail in them is astounding. That detail not only makes them more attractive, but it also makes them much harder to make counterfeit eagles, giving the owner better odds of owning the real deal and creating greater buyer confidence when selling them.

Interestingly, where these coins are made by the U.S. Mint, they are stamped with “1oz. Fine Silver – One Dollar.” In other words, they are worth their silver value and function as a one-dollar silver coin.

Not that you would ever use them that way, of course.

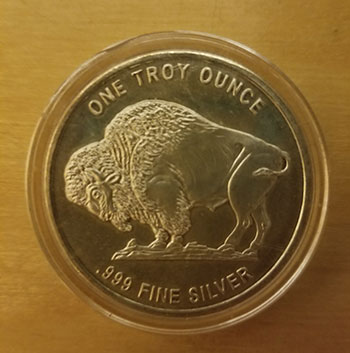

4 – Silver Rounds

Silver rounds are essentially like silver eagles, but they are not forged by the U.S. mint. They have no value beyond the silver content they contain. These come in all kinds of different variations. Here are a few I own:

The Merry Christmas round is one of several I was buying every Christmas to put in my son’s stocking. On that note, silver rounds, bars, and eagles are all great stocking stuffers and birthday gifts.

Rounds are attractive, affordable, and easily carried. They are easy to buy, sell, count, and stack.

As a play on words, you can buy another type of silver “round” – silver bullet bullion. This is silver forged into the shape of different caliber cartridges. They’re neat.

5 – Silver Bars

Silver bars, like rounds, are another way to buy silver. They come .999 fine and come as small as a single gram and can go up to 100 ounces or more!

Bars are stamped with their weight and percent silver. They have a uniform size so it’s easy to store and handle them. They are recognized around the world making them easy to use as currency.

My favorite silver bar by far is the Royal Canadian Mint Bar. They are made by an actual governmental mint, they are not just .999 pure but .9999 pure, they are stamped with a serial number, and forged in such a way that makes them significantly difficult to counterfeit (stamped back and ridges).

What is the Best Silver for Survival to Buy?

The moment you’ve been waiting for. In my opinion, the best silver for preppers to buy is a mix of both junk silver coins and silver eagles.

This is based on both recognizing the prepper’s desire to have silver for bartering purposes and the present-day value of different coins and – particularly – the ability to quickly sell your silver should you need to.

Junk silver coins are easy to buy, comparatively less money to buy, and they are the ultimate precious metal barter coin. Coming as small as a dime and as large as a half dollar, you will have no problem using junk silver coins for bartering when the collapse hits.

Silver eagles are probably the most sought-after silver product out there. I had a healthy stock of junk, rounds, bars, and eagles at one time. I had enough that I wanted to sell them so I could have the money to use toward home improvements. I listed the silver on Craigslist, and I can tell you that everyone went nuts for the eagles. That was significantly less interest in all other silver products. This spoke volumes.

How Much Silver Should a Prepper Have

How much silver should you stock? Hard to say, that’s a bit relative to your situation. Suffice to say, it should not be the first, second, third, or fourth type of product you should buy if you’re just getting into prepping. In fact, I would advise against it entirely until you are well on your way with other preps.

That said, silver is fun to buy and hold. You can watch the market go up and down and play investor. Some investors also suggest owning precious metals as part of your larger investment strategy.

Silver also makes a great gift, so that gives you an excuse to buy some (as if you needed an excuse).

If you are storing your silver in your home, and you have a fair amount of it, make sure to keep it in a fireproof lockbox and that you have assessed all of the places to hide valuables in your house. That’s the danger of keeping wealth in your home – fire and burglaries.

I always kept mind inside a safe deposit box at the local bank. To each his/her own.

Further Reading

Want to read more on silver and precious metal investing? Try these titles:

- Mladjenovic, Paul (Author)

- English (Publication Language)

- 368 Pages - 02/05/2008 (Publication Date) - For Dummies (Publisher)

- Maloney, Michael (Author)

- English (Publication Language)

- 272 Pages - 09/15/2015 (Publication Date) - WealthCycle Press (Publisher)

- Riley III, Hunter (Author)

- English (Publication Language)

- 140 Pages - 04/06/2016 (Publication Date) - The B24 Group (Publisher)

Those are my thoughts on silver. Let me know yours in the comments section.

Want to buy? Check out as Money Metals Exchange or Universal Coin for any deals they’re running.

27 comments

The real trick of any investment is to pull the trigger when it’s time to sell & not hang onto any emotions associated with the purchase. Have a plan and stick to it regardless! Parallels combat, eh?

I’ve made a fair bit and the times I’ve lost was due to veering from my plan through either fear (the fear of not replacing it) or idiotic greed or the ultimate decline happens and the “deer in the headlights” syndrome takes over. Unfortunately (pardon the pun), my losses were significant and did hurt. What can I say, live and learn not to repeat the mistakes.

What happens, is you buy an investment (gold, silver, oil, real estate etc.) and hopefully it goes up. When it does, the emotions kick in and feed a greed sensory gland (ha, ha), excitement starts brewing and perspective & reason begins taking a backseat. The next part is crucial and what separates the millionaires from the serfs….

You reach the specified & desired (annualized) return and do not pull the sell trigger! You have then entered into the emotion state and decisioning becomes a difficult chore to manage. When the investment levels & starts to decline which most do, selling is very difficult because you are outside of your plan, perspective has been abated and most people spiral to a loss or a break even, if lucky.

Bottom line – research, plan, buy AND sell – then repeat!

PS

Precious metals are very fickle and require a constant finger on the economic pulse because they are primarily affected by rumor, innuendo & negative news – all of which can change quickly – in either direction.

Read “Silver Thursday” in the following link:

https://en.wikipedia.org/wiki/Nelson_Bunker_Hunt

Though extreme, the point is to illustrate the power of rumor with little regard to base fundamentals.

Over on ANOTHER survivalist website there’s a current craze going on to acquire nickles. The older kind made out of copper and nickle. The newer kind is made out of aluminum(?). Apparently the worth of the base metals in an older nickle is 7 cents in today’s market.

So folks are being encouraged to buy thousands of dollars worth of nickles. When I asked the webmaster WHY having nickles in that volume was a good idea, I got a good answer. He said that with the value of silver being so high, if someone were to conduct a transaction with someone who accepted coins as barer, that nickles would be more versatile. Even a silver dime is like 12x face value right now (could be more, didn’t look it up), irrelevant, anyway, to my point, which is:

1. Let’s say there was some kind of crash where we started conducting our personal transactions in metal based coinage. HOW MANY nickles would a family need to do their day to day business, and since your fellow travelers are also using nickles, wouldn’t that mean that you’d be taking in nickles as well as spending them?

2. People there are admitting to buying thousands of dollars worth of nickles from banks. Some admit to buying a couple thousand dollars worth a month.

3. It’s illegal to melt down US coinage for the base metals – so even IF the base metals turned into something truly valuable – where would you go to melt them down to get the value out of them?

I guess it seems to me that folks doing this are going a little “Y2K” about it. I have two kinds of silver, “junk” silver in all denominations – and silver rounds (some of which are divisible into quarter ounce segments). I have enough, to my mind, to conduct business with like minded people out there. Again, “business” means that I’ll be making money too, not just spending money – so IF (a mighty big “if”) the US economy crashes, and IF I can find somebody still producing things and IF I am producing something someone wants, then it might be possible to create a sub-economy. As it is the only people I see bartering in coins are the typical EBAY sellers of cheap goods, or those offering ‘services’. Haven’t found a farmer near me that does this, or any livestock operations, or any doctors/dentists etc. who do. In other words the ONLY people I perceive as unrealistically conceiving about a precious metals based economy are those who are currently hoarding silver and nickles who expect to be relative billionaires during a crash. I don’t perceive of any of them as having anything I want to purchase, and I think that I’ll only be doing business with people that I consider productive – not some moneylender type with a gigantic pile of precious metals that is supposed to turn them into some kind of bank.

Have I ranted enough?

Silver is on sale NOW !

Silver is in a Bull Market and will go much higher.

buy Silver coins!

not paper silver, paper is not actual silver. Silver coins you can hold in YOUR hand can’t be scammed from you.

My take on precious metals has always been as an insurance policy against uncertain times. Not as a great money make r although my investment in them has been profitable.

I think the my greatest profit will be in the security they provide in the event of Global finacial SHTF scenario. Protect .and grow acertain part of my wealth which allows me the freedom to adjust to whatever may come.

I wouldn;t put ownin g PM’s above any of my other preps such as food,water ,shelter, preotection After these things have been covered certainly a few coins or bars would be next on the List

I have a few coins, which have been passed down through my family for at least 10 generations… I don’t care how bad it gets they won’t be used for trade! My family is (for the most part, we are technically “mutts”) Swedish, it is customary for a bride to have a gold coin in one shoe and a silver coin in the other shoe, on her wedding day, these are given to her, gold by the father-in-law-to-be, and silver by the groom to symbolize that she will never have to “go without”. I have all the coins my grandfather gave me (his mothers, her mothers- mother, her mothers- mothers- mother… you get the picture, it comes out to 12 sets of coins), and I have the set which will be *hopefully* be given to a Mrs. ChefBear someday… If she can continue to put up with me!

More to the topic at hand, and less about Swedish customs… Sorry guys!

I have considered buying some silver, just to have on hand cause you never know when you might need an indisputable form of money “money”. I haven’t done much research into purchasing silver though, I (like I would assume most folks) always thought it would be WAY out of my budget to purchase anything bigger than the .999 silver custom-made bracelet I gave my girl for Christmas. Thanks RangerMan, it was pretty cool to check out those links at the end of the article. I had no idea that “the average Joe” could buy silver like that, and whats more at a somewhat reasonable price. One question though, as far as a “strict/intended monetary value”, how much are the 1oz rounds supposed to be worth? It’s obvious that it’s a coin, but I didn’t see a denomination note imprinted on it… Unless of course I am just blind, which after the day I’ve had, that’s certainly possible!!

Another thing I think is important to note, and I must apologize because it only somewhat relates to the topic at hand. PERSONALLY, I think that if we find ourselves in TEOTWAWKI, rather than a short-term SHTF situation, we will find that communities will start using a trade system similar to what would be found in a TRUE communist atmosphere (The USSR was not a TRUE communist country, because they had several “classes” of citizens). What I mean when I say that, is that in a TRUE communist society/economy is based on trade of goods and services, rather than by using money to purchase what you need. I think that those of us who have skills which are needed for things like plumbing, farming, alternative energy (let’s face it, we will still want our radio/TV if it’s possible), blacksmiths, tanners, butchers, bakers, doctors (of course) just to name a few, would make up the base of the new economic structure, and probably do better than most others trying to make a living in different ways. I also think that if we go through a TEOTWAWKI scenario that doesn’t involve the complete decimation of the human race, we will see a system which our great-grandparents would have been familiar with. I also think that the economic structure would be regional, rather than national/international. But again, this is just my opinion!

The thing about PM’s, are the way their buying value stays the same. The “$” value is what changes. PM’s are not an “investment,” it’s more like a savings account.

The value of a silver dime converted to USD ($) still buys the same amount of goods.

When you sell it your only getting what the paper value is. Sure you get “more” money, but that money buys less.

Folks say buy junk silver, but have you tried to sell “junk” gold?

Is that $1000 (retail) diamond ring really only worth $100 at the pawn shop? (On a good day.) Try to sell 14k gold. And they won’t give you it’s true value, because of “meltdown fees.”

Junk Silver on the other hand has NO meltdown fees! Just its obvious value.

It’s (probably) too late to use our empty (inflated) money, to buy gold/silver. It’s much better to buy food/lead/brass/iron, while it’s still available/affordable.

How much gold/silver will you take for your last can of peaches?

Buying/storing nickles is silly! Sure it’s nickle, but what can you do with it besides plate metals with it?

And what about gemstones? Just pretty rocks… (“I’ll give you 3 aquamarines and 2 rubies for a gallon of gas!” &/or, “Got change for a .5ct diamond?”)

I agree with the comment that said the folks holding large PM’s might become bankers. At least the “money” they’ll lend/sell you will not be paper!

The main reason to store gold/silver is for paying taxes/extortion. Taxes will hurt even more when paid in PM’s perhaps enough to offer to pay in lead!

BTW, you can hire me for only 25c (Ag) an hour!

Yup, that could be the subject of another post – trying to actually SELL your silver. The key, I believe, is first to buy it at less than melt value, like a coin dealer.

The 1 oz rounds aren’t “coins” at all, they just look like them. Think of them as 1 oz bars of silver, only stamped into circles … with a design …

I agree that some people seem to be going overboard buying tons of nickels. More rants!

I was looking at very small gold amounts. You can buy a gram ‘bar’ of .999 gold for $60 or so. Of course that is a huge premium over the current ounce price but at least it is small enough to barter with.

Update, 3/23/11

1 oz Silver up over $37

Buy physical Silver coins or bars and hold them.

CRASH JP MORGAN BUY SILVER

In reading the “other” replies, the following occurs to me…

Just wonderin’ but isn’t “pulling the trigger” on an investment EXACTLY what got us into this mess? Everybody wanting to make a percentage on the original investment, rather than a portion of the profits generated by a company?

It used to be true that IBM, Polaroid, etc… paid dividends to regular stockholders. Then at some point the “preferred stock” was invented and the only thing “common” stock got you was the right to sell it. At this point the big investment accounts, like large trust funds and retirement funds have bought up most of the long-term dividend paying stock that exists – and the only thing us common guys can get is common stock that pays NO dividends. Which pretty much means that like the housing market, you HAVE to sell it for more than you paid for it (mini pyramid mentality) in order to make a profit.

it’s almost like common stock was invented so that those people with small amounts of money to invest in something would literally hand it over to the big guys with NO promise of return.

Ick, I hate the stock markets – they are no longer how you grow a nation strong, they are how the rich transfer wealth to themselves and unless you’re on the “inside” you’re never going to make much.

I have a lot of respect for the Muslim way of doing banking. A lender CANNOT charge interest. As an investor (lender) you are entitled to a share of the profits. They don’t have derivatives (look it up, it’s essentially a bet – but dressed up as something acceptable). They don’t have hundreds of legal schemes meant to convince us to give our money to people we haven’t even met, with NO IDEA whether or not the company we’re investing in will actually make a profit, in fact, we are encouraged not to care if the company is viable.

Anybody remember the dot-com bubble? Companies that were internet based were bought and sold for months before they EVER put out any product or service. Some companies were worth 400 million on paper, and they hadn’t even set up operations yet.

20 somethings involved in those companies then went out and traded their shared in the company for other shared in other companies and without creating one drop of sweat, were millionaires almost literally overnight – and NOTHING ever got produced.

I think that when were at TEOTWAWKI the banker types are going to go hungry, because those of us who produce things will see them for what they are – a reincarnation of “Mr. Potter” from “It’s a Wonderful Life”. They’ll have a pile of gold, they’ll WANT whatever it is we produce, but have nothing of real value to trade for it. I mean, has anybody actually thought how someone will decide that 1lb of butter will be worth 1 silver dollar/quarter/dime?

Precious metals are a way of concentrating wealth, perhaps the FIRST way of doing so, without industrial processes to actually use precious metals they are worth no more than paper money, the only advantage to them is that inflation is flat because you can’t just print more silver or gold. With the concentration of money, comes the same old system of wealth that brought us here. So i think the banker types SHOULD go hungry, because their only plan after the crash is to take advantage of those of us with REAL tangibles, again, doing it by convincing us that something weighing 1/10th of an ounce, is worth both of our draft horses, or our entire year’s honey production. The concentration of wealth in this manner is only justifiable when you consider that it’s easier to haul a pound of gold to a distant city, than 1 ton of grain – this assumes a supply of things in the distant city that you want to buy.

Sharia banking, though, offers a much better idea. yeah, I know, muslims dont get EVERYTHING right – but I think they hit this one on the head. I think that Christian’s have forgotten an essential principles, remembering that Jesus tossed moneylenders from the temple, that there ARE biblical references to the charging of interest as immoral. It is currently illegal under the law for an Israelite to charge interest to another Israelite, but NOT to do so to a foreigner (which I consider equally immoral).

Usury USED to mean simply “interest” it’s been twisted just this century to mean “excessive interest”. Wikipedia has a good bit of reference to this:

https://en.wikipedia.org/wiki/Usury

It all comes around to HOW we use what we consider “money” when things collapse, or even currently.

me? I do loan money to friends, I even loan money to strangers – and for a long time I didn’t charge interest, and I didn’t know why… Now I know why I don’t, and I still don’t charge interest when asked for a loan. Either something is a good thing to do in and of itself, or it will increase the fortunes of those I lend to, thereby increasing MY fortune.

Argh, ranting again, aren’t I….

Nuf said though, gathering silver and gold with the idea of being “on top” if things collapse is something I find morally corrupt, what YOU do is subject to your own code, and I don’t hold others to mine.

About selling gold… I’ve though about that crappy deal for years! I had gold, and needed my plumbing repaired, fast! And asking around got me “offers” that were essentially the same, crappy.

Carat gold, 14k, etc… Isn’t the same as a “easy to move” coin. With a coin you pay the % up front when buying it… (N% over spot) and then sell it for spot.

But as the price of gold goes up, it becomes like a “hot potato” (with a $ grenade as the tater!) And no one wants to get stuck with a bad deal… So, the crappy buying prices… They too need to profit.

So a bracelet WILL NOT hold it’s value the way a coin or bar will.

I’ve been a (small time) jeweler and I know, the markup is huge! (It was a great gig for a while… When there was an economy!)

There’s talk that the value of gold is just like that of diamonds, and are being manipulated by the uber-riche.

After all, it’s a easy way to get gullible suckers to pay MORE for something that’s basically useless.

If you’ve paid a crazy amount for gold and get stuck with it, then you lose.

Suppose you paid $100 and a buyer will only give you $50? It’s a bad feeling… Just ask anyone that’s had to “hock” stuff!

Anything, is only worth what someone is willing to pay!

Great response.

If TSHTF then silver and gold can turn out to be very poor investments. You can’t eat it and you can’t shoot it to protect what you need to eat.

A non computer controlled diesel or gas powered vehicle that actually runs after a disaster on almost anything has great “right there value”.

What is worth more, a big family van or a diesel 6×6 gator when it comes to moving over areas where roads no longer exist and are under 2 feet of water, like Japan is right now.

If you are a store owner and the economy has collapsed, would you sell your last scraps of food for silver or a good .22 pistol with ammo?

Metals are a hedge against inflation, and yes, I think having a gold, silver, steel, and aluminum collection does not hurt. The thing is one ounce of silver today buys just about the same amount of food one ounce of silver did back in 1960. Back in 1960 you could buy a loaf of bread for $0.25 that weighed 160z. Now you have to pay $1.50 for the same pound of bread.

If I had $20K, I would make sure I had a garden, food stored, ammo, and guns to sell before I ditched it all into coins and metals. Metals only work with an economy in place, except if it is easy to melt like lead and you can actually make bullets, roof patches, etc. with it right in your backyard.

If TSHTF and everything collapses I think I rather have $30 of AA batteries then one ounce of silver.

Though I rather have one ounce of silver then $50 worth of stock in a company, right now.

Everyone seems to be a little hung up on TEOTWAWKI and naturally everyone has their ‘favorite scenario’ but to say that PM will be worthless is a bit of a jump. Now I totally agree that if the Gov came crashing to a halt TOMORROW then yes, PMs would probably do you little good. However, that is just about impossible and the LEST LIKELY thing that could happen. Not that the Gov couldnt crash in a day but PEOPLE wont believe it, the sheeple will still hold on to their beliefs. That is why so many pack spare cash in their BOBs! During the first week of a “Realistic” meltdown people will still be taking cash-will there be massive inflation? of course. cash will eventually give way to PMs and the sheeple will be taking gold and silver for what they have because they HONESTLY BELIEVE that the Gov will recover and when it does they will be better off/richer. And yes, eventually you guys will be right- people will start to understand that it is just pretty metal at which point we will be back to bartering goods and services strait up.

The issue here is *HOW LONG WILL THAT TAKE*?? Because if you think we will enter into a barter system within a week of “the collapse” you are going to be a bit surprised I imagine. It will take time, it will take realization on the part of the masses. PMs defiantly have their place- Right in between disaster and full out collapse. Which quite frankly, is more likely or at least going to happen sooner (by its very nature) than a full societal meltdown.

If you are a fully self sustaining individual that needs nothing from no one and no emergencies befall you then dont bother with PM, but if youre part of the vast majority that may need SOMETHING in the intervening time that it takes to degrade into TEOTWAWKI (…perhaps years???) then PM may have a place in your planning and preparations.

hi, I see alot of talk about how the American Prepper can buy coins, rounds and bars, etc

but i am in Australia, and my head is spinning looking through hundreds of webpages for choices for the Aussie market,

should i just go with Scrap Silver-looking through old coins and trying to pick up something of value?

thanks for reading

You don’t have any coin stores?

no coin stores, im new to prepping-started with food and water supplies, started to grow some veggies with little space i had, and now i am ready to move into the precious metal side of prepping,

but i am in Australia, and am lost at were to start. Lots of info on “buy America Eagles” and get pre 1966 dimes and so and so

but as an Aussie do you have any specific advice?

thanks

Lotsa great philosophy here in he comments. My comment is for Derrick’s line in the article that he always kept his stash in a safe deposit box in a local bank. I hope KEPT rather than KEEP is the operative act. IMHO a safe deposit box is the LAST place I would want to keep anything that I valued or that I needed reliable or immediate access to. I am referring to the scenarios where bank doors are locked and there is no access to assets. What if your bank is in downtown Portland? Or Kenosha, WI – near where I live. Or where ever. I would sooner trust access to a hollow log….or some other clever hiding place.

Thanks, old guy. It is KEPT, but largely because I don’t have that amount any longer.

Silver can be definitly be used for healing. There are a large number of silver infused gauzes, some prescription grade, and there is the burn ointment Silvadine. Not to mention colodial silver mixes, that can be ingested or applied to bandages and wounds. Silver, processed for such usage, would increase its trade value during SHTF.

Collected a complete set of Morgans over the years. Multiple purpose. Hobby for me .Legacy for the family not subject to taxes or probate after I die. Portable store of value for hard times.

Robert (QSLV)

A couple of items to consider:

1) Have a plan for how you are going to divest yourself of the silver and why you are buying silver. This should shape what silver products you are buying.

2) Be mindful of premiums – As mentioned, Silver Eagles are very popular, but the premiums for them can make the cost YOU pay much more then you might be able to make back on the coin itself.

3) Unless you are into Numismatics, stay away from “certified” silver products or specialty products like colorized items – Like Baseball cards and Comics, you are speculating on the value of something based on its artistic value vs the base value of the silver.

4) Actual monetary coins, such as Eagles, Maples, Britannias, and Pandas, tend to retain value better then rounds, but rounds are better for buying by weight as they usually have lower premiums. With Rounds (or Bars) you are more likely to get Spot price when selling to a coin shop.

5) As mentioned above – KNOW WHY YOU ARE BUYING – so that you know when to buy. Many people get into a craze about buying something because everyone is doing it and end up buying when prices are highest. You really want to be buying when it is low. The people following the craze de jour are the ones that end up losing money.

While I haven’t read Mike Maloney’s book, I do listen to his podcasts and find them helpful, along with a few other Silver Bugs out there.

All good advice.

You can keep silver for bad times ahead or pass it along after you leave this world. Times get really hard… melt it down for ammo parts.

Nic Article Derrick, I think Silver is a good investment. According to me because the value of silver depends on the spot price. Also, when you purchase it if you purchase it when the spot is high, then the returns on it may not be that high, but if you invest at a time when the spot is low, it will definitely help you further. As you know, Many Dealers like Apmex, Sd Bullion, And BOLD Precious Metals are there when you show the spot price you live, and a variety of products are available on the site you and. They have also written a nice blog about precious Metals Investment so you can get an idea of when to invest in Precious Metals.